The Crypto Mullet: The Dichotomy of the Culture

Pongo Points:

• The crypto industry attempts to onboard serious companies while simultaneously pushing the "decentralized" ethos. Despite being fundamentally incompatible with regulated societies, decentralization hasn't proven to be a more effective means for companies to govern themselves. Now, it appears that some crypto advocates think everything should be decentralized, which makes the industry seem juvenile.

• Much of the crypto world lacks the gravitas and professionalism that most of the corporate world exhibits. It's not so much the parties and young CEOs, as it is the blatant pump-and-dump schemes like $PEPE reaching "valuations" in the hundreds of millions of dollars. Sure, other industries experience similar scams, but the frequency with which they occur in crypto make it seem like the technology is ephemeral.

• The crypto community often fluctuates between seeking validation from legacy economic systems and deriding them for being inefficient, unfair, or incompetent. Crypto cannot exist in this limbo state and expect to be taken seriously by non-industry participants. Eventually, this flip-flopping will lead to a fork in the community: Integrate with the existing system or create a new one - which way western man?Business in the Front

Networks are infrastructure, not products. Blockchains are infrastructure, not products. Many products use networking (or the internet) to generate profit, and many products will use blockchains to generate profit. However, the notion of being “part of the internet” is not a product in itself, and “being a blockchain” is not a product either. There is a strong desire by many exploitative firms and individuals to commoditize blockchains to sell tokens, even if the tokens serve no functional purpose.

One of the key advertising tactics used by these pioneering profiteers is the idea of decentralization; something this ape is quick to criticize DeFi and various blockchains for marketing. The idea of decentralizing the development and management of products has an appealing anarcho-capitalist flavor for some, but it’s not a practical way to govern. After all, humans have been organizing into groups for millennia in order to become more efficient, so just because the internet allows us to “de-organize” physically, doesn’t mean it’s always practical to do so.

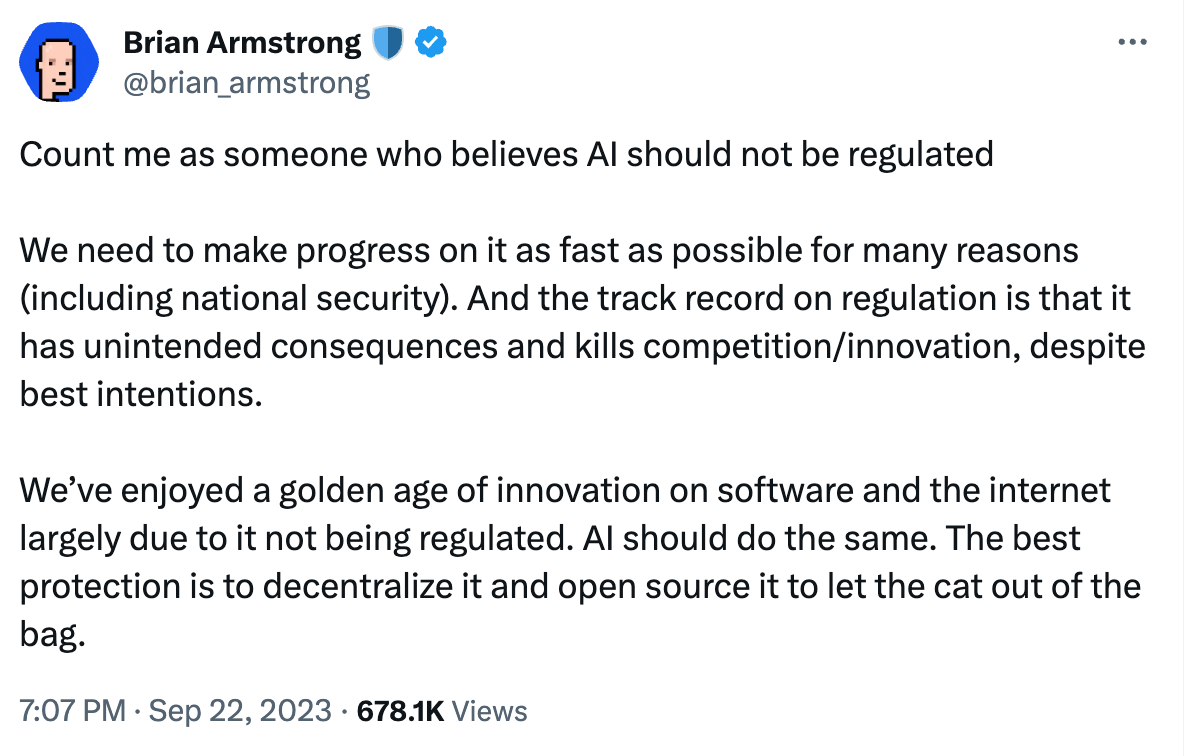

Brian Armstrong is one of the founders and the CEO of the Coinbase exchange, a tremendously important component of crypto infrastructure today. While this ape acknowledges and appreciates Brian’s efforts to bring attention to Bitcoin and blockchain, there’s a big difference between how the internet developed and how artificial intelligence might develop. Brian’s suggestion that AI should be freely researched without any protections probably would be great for rapid innovation! Unfortunately, it might also bring about consequences that are much more difficult to contain than if smart regulation were applied.

Yes, the internet enjoyed fast integration and improvement thanks to its “no rails” development, but it created messes that are still being cleaned up or remain unaddressed (like doxxing, spam, scams, theft, stalking, sharing and sale of illegal items, etc.). Now imagine the problems that can be caused by an artificial intelligence with the ability to penetrate every network in the world (including your bank, medical providers, and more).

Party in the Back

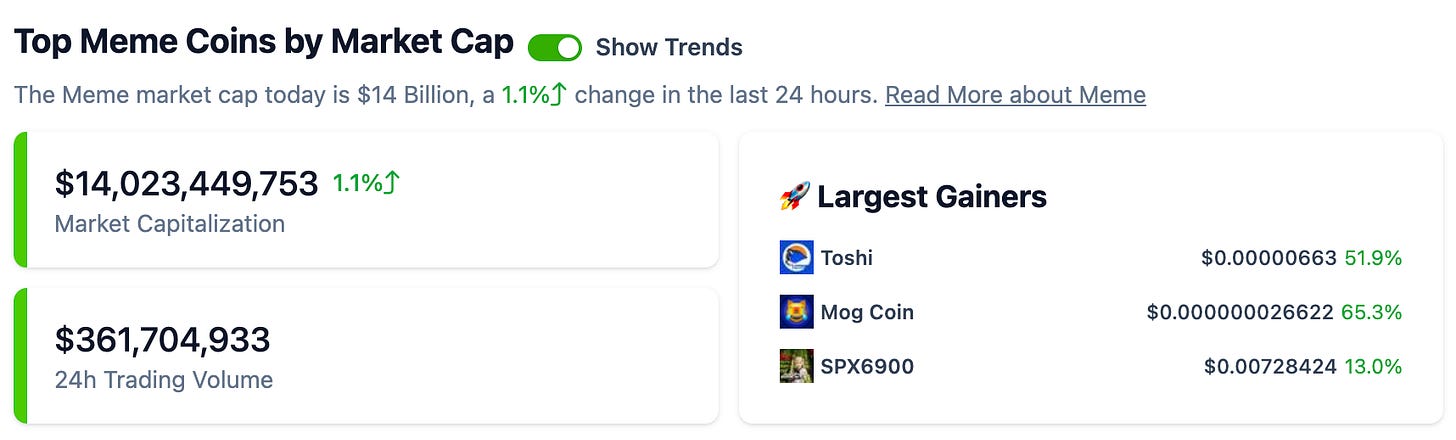

Many crypto advocates are pushing for the decentralization of governance powers, which they believe to be a serious endeavor. Meanwhile, an entire category of cryptocurrencies called “Meme Tokens” enjoys a market capitalization of around $14 billion. These tokens serve no purpose, acting more as collectibles and community building tools than actual investments. (Even that definition might be too generous, as they are mostly pump-and-dump schemes.)

Of course, there are a number of scams throughout every industry in the world - it’s the nature of dishonest players seeking opportunity through the ignorance of others. However, the crypto industry has made itself very attractive for scammers, since new technologies present the prospect of legitimate riches and for tremendous confusion. Said differently: You can become very wealthy investing in crypto, but the technology is complicated enough so that most people aren’t able to navigate the space intelligently to accumulate great wealth.

Meme tokens certainly make things more difficult. It can be demoralizing for an honest investor to be sitting on 12% S&P 500 gains year-to-date (or 63% for Bitcoin), all while some Gen Z’er made millions in profit by buying and selling Pepe Coin at the right time. Those are the crypto headlines we might see, because those who lost tremendous sums of money buying Pepe at the wrong time isn’t an interesting story. Never mind those who invested in legitimate projects that failed due to lack of adoption or product-market-fit.

Exacerbating the meme token problem is the frequency with which they occur. Nearly every month there’s a fresh meme token that mints new millionaires thanks to profiteering off of those desperate for immediate gain. To name a few in just the past few months of 2023: Mog, Banana Gun, and, of course, HarryPotterObamaSonic10Inu Coin. (Thankfully, all of these coins are “decentralized!”) If these are any indication of the use of blockchain, then there’s a long way to go before there’s serious adoption of the technology.

Fresh Cut

Between courting major businesses to adopt blockchain and offering latest in meme pump-and-dump technology, the crypto industry appears unserious to some. However, much like the early days of the dot-com era, blockchain as a technology will experience some turbulence before it enjoys global adoption. (Note the distinction between the “crypto industry” and blockchain, as crypto is more focused on selling the idea of decentralized tokens and this ape believes blockchains will be adopted differently.)

It took the failure of a handful of companies and the reorganizing of dozens more for the dot-com bubble to flourish into the internet we all use today. Crypto and blockchains have already experienced three similar bubbles, but not at a scale that wiped out the majority of the “garbage” in the system. If anything, each crypto boom-bust cycle inspires even more garbage to enter the system. The internet certainly experiences its fair share of scams (to the tune of nearly $10 billion per year), but crypto scams are more sophisticated and can affect even those who some consider “capable.”

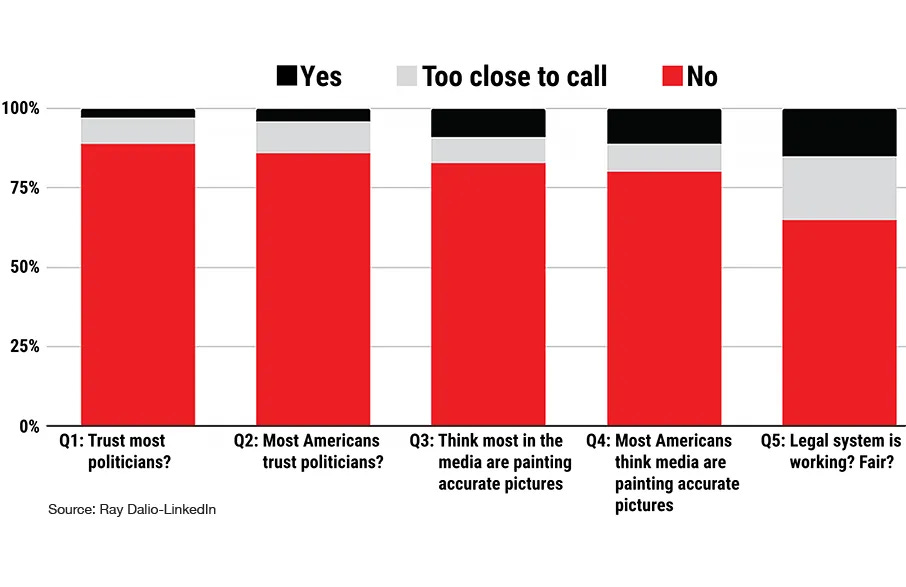

In order for blockchain adoption to flourish, in any form, the crypto community should focus on developing the technology to improve corporate and government oversight. Blockchains are really just inefficient accounting ledgers, but they’re ledgers that force transparency, honesty, and cooperation from all who use it. Bad actors and mistakes are immediately rejected by the blockchain network, and all users are incentivized to act civilly. Why is that useful? Because public trust in politicians, media, and companies is eroding fast (thanks in part to the internet and accessibility of information).

While the fast cash from a pump-and-dump scheme benefits a few, it also paints the technology in a bad light. (Despite many scammers being often tracked down and brought to justice thanks to blockchain’s transparent ledger!) It’s difficult to imagine Samsung or Google wanting to enable the proliferation of more tokens like HarryPotterObamaSonic10Inu, let alone allowing them on their blockchain platforms. It took flops like Pets.com and WebVan for the dot-com era to mature into the internet of today. It’s time for crypto’s “grow-up” moment.