The Bitcoin Battery

Consider the following LSAT-esque logical reasoning question:

Hal: Bitcoin mining today uses a lot of electricity, because there are a great deal of mining machines that use the energy to secure the network.

Finney: The primary sources of U.S. electricity generation are natural gas and coal. Globally, the sources of electricity are more skewed towards coal than natural gas.

Elizabeth: Natural gas is bad for the environment because it is mostly methane, which is a strong greenhouse gas. The emissions from burning coal to generate electricity are also bad for the environment.

Warren: All of you are correct, therefore Bitcoin mining is bad for the environment.

Is Warren’s conclusion true or false?

The Facts

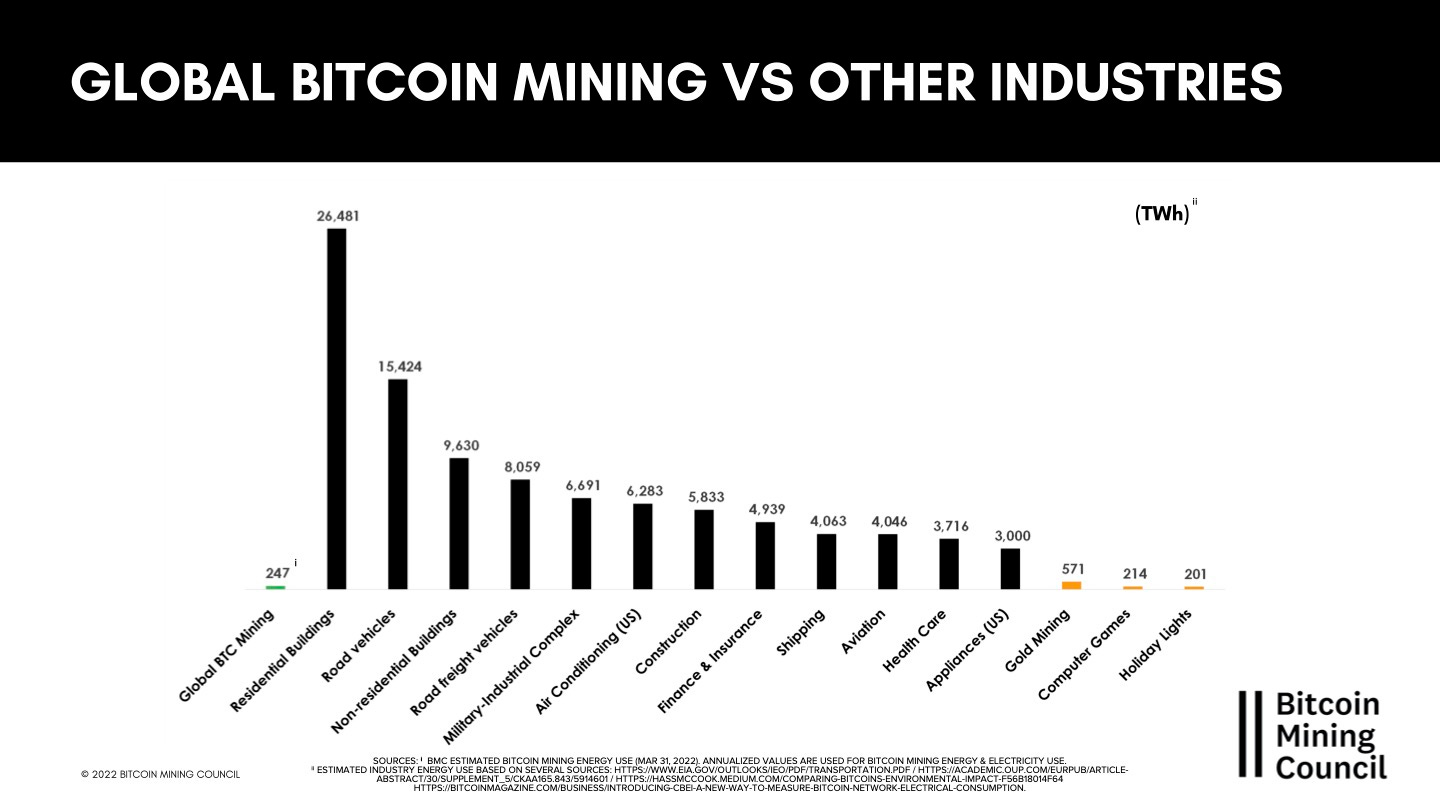

Hal’s statement is correct, because Bitcoin mining does use a lot of energy.

A common comparison that you may have seen is “Bitcoin mining uses more energy than Sweden!” While that seems incredible, consider this: Sweden has a population of about 10.2 million and there are an estimated 82.2 million Bitcoin wallets as of April 6, 2022. Additionally, Sweden’s GDP is about $541 billion and Bitcoin’s current market capitalization is about $560 billion. So what does that mean? Nothing, really…

You can compare Bitcoin to a country all you want, but it’s largely irrelevant because they do different things. Amazon’s annual revenue would make it around the 25th largest country by GDP, but I can’t imagine that the UN will give Jeff Bezos membership anytime soon. Ultimately, a country is a territorial body with a governing entity. A company is legal entity with a governing body. And Bitcoin is, well, software.

The second half of Hal’s statement is also true - Bitcoin’s security model depends on a wide network of miners to process transactions and secure the blockchain. Without getting too deep into Bitcoin mining and how it works, more miners is generally a good thing for the network. If you’re interested, Frontiers has a not-so-brief research paper on the game theory behind cryptocurrency mining that details how competition makes for a robust and secure network.

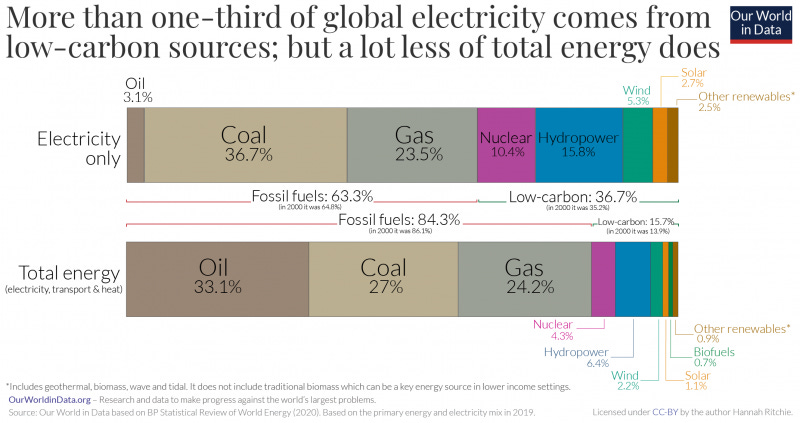

Both Finney’s and Elizabeth’s statements are accurate, based upon data from the U.S. EIA and Our World In Data reports.

First, Finney is correct in stating the majority of electricity is generated by burning natural gas or coal, both in the U.S. and globally. Renewables make up only 20% of the total in the U.S. and about 26% globally, with hydro and wind accounting for the majority of those figures.

While renewables are a growing percentage of the overall makeup, there are still many barriers to overcome before they can become a more significant portion of electricity generation worldwide - namely:

Supply-Demand Dynamics - if everyone wants to charge their electric vehicle at the same time, is there sufficient supply to satisfy that need?

Variability - the sun doesn’t shine at night and the wind doesn’t always blow

Transmission - energy is lost when carried over long distances, and most cities can’t install windmills everywhere

While nuclear power is sustainable, it is technically not renewable since uranium is not an inexhaustible resource (unless you want to get into an argument about the infiniteness of space…) However, I fully believe that nuclear energy is a critical component of a low-carbon future. One of the best resources for information on nuclear energy is Doomberg. They are sincerely one of the best teams putting out accessible articles on energy, and I’ve been an enthusiastic reader from day one.

Of course, there are technologies that might be able to help subsidize renewable energy penetration…more on that later.

Second, Elizabeth is also correct, though her first statement about natural gas might be misleading in the context of that conversation. Extracting and burning natural gas is not “good” for the environment, as it still releases greenhouse gases into the atmosphere. However, it is critical to note that the emissions from flaring natural gas are not as damaging as using other fossil fuel power sources.

While it’s not perfectly clean, natural gas is a reasonable way for society to wean itself from more harmful power sources like coal. Many renewable energy technologies need more time in the oven to sort out reliability and accessibility problems. Shifting to a fully renewable grid today is technically possible, but that might end up like opening the oven before the soufflé is ready…

The Allegation

Bitcoin mining is bad for the environment.

The notion that Bitcoin mining is bad for the environment is likely derived from three core assumptions hallowed by crypto-skeptics:

Bitcoin miners emit greenhouse gases and/or pollutants

Bitcoin serves no economic purpose

Mining machines generate electronic waste from short-lived hardware

One of the least charming, yet most legitimate counters to the first point is: The act of mining Bitcoin does not emit pollutants. In response to a letter by Representative Huffman and 22 members of Congress, the Bitcoin Mining Council offers an incisive riposte:

There are no pollutants, including CO2, released by digital asset mining. Bitcoin miners have no emissions whatsoever. Associated emissions are a function of electricity generation…Digital asset miners simply buy electricity that is made available to them on the open market, just the same as any industrial buyer.

To suggest that Bitcoin mining is bad for the environment is like saying Teslas are bad for the environment. They both run on electricity, yet few people consider the source of the electricity that they use to charge their eco-friendly car. So why do environmentalists make efforts to point out Bitcoin miners’ energy sources?

“Because Teslas are used for transportation and Bitcoin does nothing!”

Bitcoin is censorship resistant medium of exchange that’s available anywhere in the world (with an internet connection). It may not be valuable to you if your country has a stable currency and permits you to buy nearly anything you want, but outside of your bubble Bitcoin might be a lifeline to those living in oppressive states. Besides, someone who rides a bike everyday might think it’s wasteful to use electricity to drive 5 miles to work!

Finally, one of the least compelling points for the Bitcoin is bad for the environment spiel is the electronic waste generated by short-lived, specialized hardware. The lifecycle for each generation of mining hardware isn’t much shorter than consumer hardware like smartphones or laptops, and parts are more easily recycled since they don’t contain batteries. Plus, while Bitcoin miners prefer to use whatever hardware is most profitable, they will generally use any hardware that is profitable.

Throughout the many boom-bust Bitcoin price cycles, miners have focused on a variety of metrics to ensure that their business survives. Bitcoin mining hardware becomes more efficient over time, as is expected, but new hardware doesn’t immediately take over the market. Besides the obvious hurdle of actual availability for the latest machines, old hardware can still be profitable to run at certain electricity rates and depending on the price of Bitcoin.

The chart above shows the price of the latest miners in red, the previous generation in orange, and the generation before that in yellow. The index assigns machines to a generation based on mining efficiency, which is the amount of electricity consumed for each calculation - where a lower number (J/TH) is better. As is evident, each generation of hardware is dependent on the price of Bitcoin, but older generations still have value regardless of age (i.e. they are still profitable to someone with low electricity costs). The oldest hardware in the chart above is 4-5 years old, but the price of Bitcoin rising made it more valuable than the latest hardware before the price spike.

The Evidence

Many renewables are intermittent energy sources.

The NREL, a research and development center of the U.S. Department of Energy, has conducted many studies on energy curtailment - the process by which energy producers involuntarily halt operations because of excess production meeting limited demand.

Per a NREL study from May 2021:

We also find that demand-side flexibility—especially from newly electrified loads—can enhance operational efficiency by reducing VRE [variable renewable energy] curtailment and increasing utilization of generators that have lower operating costs.

Earlier studies by the NREL note the economic impact that curtailment has on new production sites, citing that “contracts [between generators and off-takers] are increasingly reflecting a negotiated number of annual hours in which curtailments are not compensated.” As with nearly every business, supply vs. demand generally dictates price. In the case of renewable energy, variability impacts the viability of future infrastructure projects.

Berkeley Lab is another national lab that has conducted similar studies on demand-side flexibility. On their website, they suggest similar findings to the NREL:

Demand flexibility can help build a cleaner electric grid by adjusting usage to take advantage of energy from renewable sources such as wind turbines or solar panels when supplies are high.

Curtailment is an inefficient and costly reality of many renewables, as power is produced at the mercy of the elements - not like natural gas or coal that can be switched on and off to accommodate demand. While too little energy from renewables can be augmented by turning on fossil fuel generators, having too much energy from renewables is useless without batteries or somewhere to route the excess.

What does any of this have to do with Bitcoin mining?

Bitcoin mining is a flexible load industry.

And that makes it an appealing partner for variable renewable energy producers. To that end, Bitcoin miners have already begun to coordinate with grid operators and renewable energy producers to negotiate power agreements. Because Bitcoin miners can be easily turned on and off, they are eager buyers for unused power. In addition, electricity generators no longer need burden the cost of starting and stopping operations due to irregular demand.

“But wouldn’t Bitcoin miners be losing money when they turn off?”

Renewable power generators can cut great deals when power supplies are high. If they weren’t being compensated at all when curtailing power, then any income Bitcoin miners offer them is a boon. Even if it means shutting down operations when there’s high energy demand, Bitcoin miners are happy to accept terms in exchange for lower cost of power, because electricity accounts for over 70% of Bitcoin miners’ expenses.

“But what incentive do Bitcoin miners have to shut down their operations?”

Either contractual obligation, government intervention, or (shockingly) common sense. As recently as May 14th, the Electric Reliability Council of Texas (ERCOT) issued a notice to miners to ramp down operations due to an anticipated surge in consumer demand. Massive data centers powered down, and on May 20th ERCOT CEO Brad Jones complimented the Bitcoin miners’ response to the tight grid conditions. But beyond providing stability to the variability problem, Bitcoin miners are finding other ways to improve low-carbon energy production.

Bitcoin miners are invested in sustainable power.

While it is true that some Bitcoin miners use dirty energy (i.e. coal powered electricity), a recent survey of Bitcoin miners around the globe suggests that the majority of mining companies are using a more sustainable energy mix than average. Per the report, approximately 58% of all Bitcoin miners are using sustainable power, which is substantially higher than most other industries and countries. This is likely due to renewables and nuclear offering miners a cheaper source of power than fossil fuels.

Because sustainable sources are likely to remain cheaper in the long term, miners are already seeking to minimize future costs with forward-looking projects. The industry is striking deals with new sustainable energy sites, such as Talen Energy’s nuclear venture with mining company TeraWulf. The benefit to Talen Energy is a guaranteed customer with TeraWulf, while TeraWulf enjoys cheap, zero-carbon electricity. More projects like this should improve the economic viability for future sustainable energy infrastructure projects.

The Judgment

Warren’s statement is false, as it relies on uncorrelated information to draw a conclusion about Bitcoin mining.

Hal is correct that Bitcoin mining uses a lot of energy. Finney is correct about the common fuel sources for electricity generation. And Elizabeth is correct about the harmful byproducts of fossil fuels. But Warren is assuming that Bitcoin miners are 1) directly emitting pollutants and 2) using electricity produced from the same energy mix as the global average - both of which are incorrect. If anything, Bitcoin mining is proving itself to be a tailwind for sustainable energy - not “polluting communities” and “having an outsized contribution to greenhouse gas emissions” as some U.S. representatives might have you believe.

So why did I title this “The Bitcoin Battery” when I make no mention of batteries? Well, batteries are viewed as another way to improve renewable energy penetration by storing excess power, but I’m unconvinced about the longterm viability of that thought. If the world continues to electrify all aspects of everyday life, why not focus on directing battery materials to manufacturing and let Bitcoin solve the variable energy problem?