Show, Don't Tell: Why It Feels Like Bitcoin Is "Losing" to Ethereum

Pongo Points:

• Decentralized and permissionless systems are a double-edged sword: The openness of the system is, ironically, its greatest weakness too. A major pitfall for any decentralized system is that there is no central authority with a vested interest to continue pushing development and iteration. As a result, factions can form and delay progress.

• Bitcoin's block subsidy is the current way miners sustain themselves. Over time, the amount of fees paid to transact on the Bitcoin network will compensate for the declining subsidy - at least in theory. There is now a contentious debate about how to keep miners invested in the future of the Bitcoin network through the use of drivechains.

• Drivechains are a suggested addition to Bitcoin's code, whereby miners would be protected by a number of side blockchains (or "sidechains") that vie for Bitcoin blockspace and drive up transaction fees. On the other side of the argument, could drivechains take away user interest from Bitcoin and just trade user-fees for company-fees, without meaningfully increasing miner revenues?Summarization

A common trope for creating decentralized digital infrastructure is that there is a reduced need to trust individuals, corporations, or governments. Computer code is inherently agnostic to the social biases that all humans are both subject to and perpetrators of, so it is perceived as a more fair way to administrate than a “racist company” or “bigoted government.” The basic thought is that it is better to trust publicly reviewable code than to trust Google and its employees.

The argument against building a totally decentralized and permissionless systems is that there is no central body that can orchestrate continued development or improvement. A company like Apple or Microsoft must continue to develop new services and products, otherwise they risk becoming unprofitable and forgotten. This isn’t to say that decentralized administration is impossible: The internet is largely governed by a number of interconnected agencies, companies, and international bodies.

So where does that put Bitcoin on the “decentralized-to-company governance” spectrum? It’s definitely closer to the internet, as nearly all of the research and development for the protocol is done by volunteers, grant winners, and companies. (It’s not clear if there are any governments pursuing Bitcoin research, but it’s certainly likely.) As discussed in The Foundation Problem, Ethereum is closer to Google or Apple but still relatively decentralized, and nearly every other crypto is even closer to traditional corporate governance.

It’s because Ethereum boasts a “foundation” that is so central to protocol upgrade decision making and implementation that it feels like Ethereum is growing at a much faster pace than Bitcoin. There is, however, a contentious debate among the Bitcoin-focused developer group with respect to a potential upgrade to the Bitcoin protocol. This is a big deal, as the last major upgrade to Bitcoin was in November of 2021. (For reference the internet’s last “upgrade” was in 2012 with IPv6.)

The Show

Bitcoin are generated in a process called mining (and I’m sure you’ve all read the “it’s a bunch of computers solving puzzles” line by now). There are currently 6.25 new Bitcoin created every 10 minutes or so, which equates to about a $168,750 subsidy for miners (at around $27,000 per Bitcoin). That subsidy decreases by 50% approximately every 4 years, with the next “halving” likely occurring in April 2024 - where the subsidy drops to 3.125 Bitcoin, or $85,000.

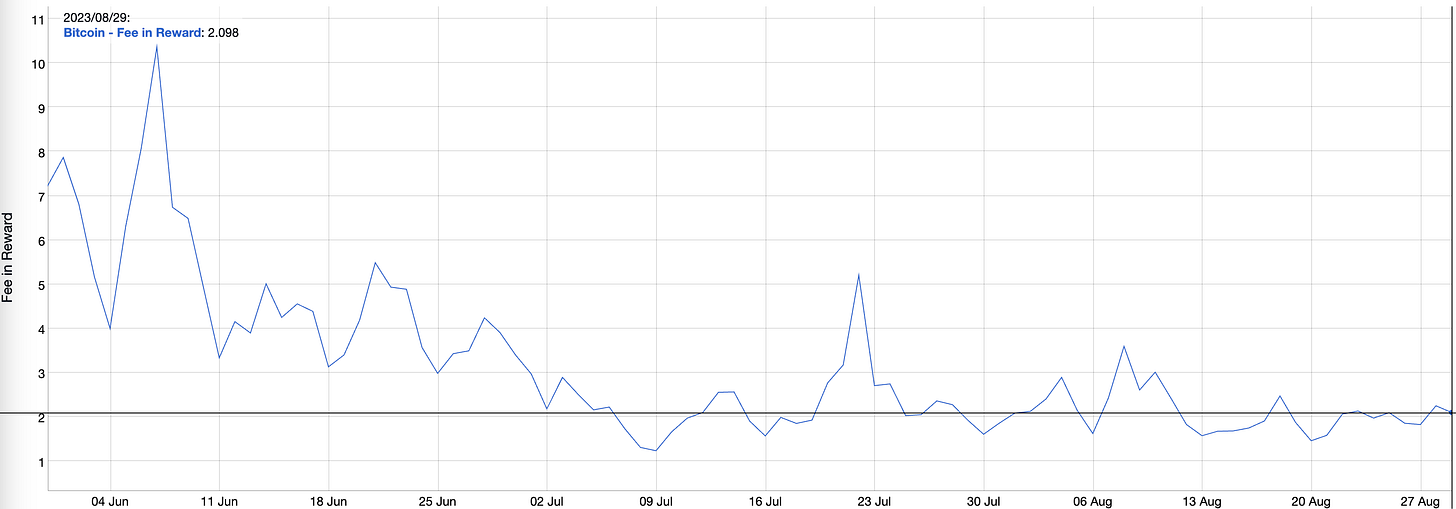

Without getting into the nitty-gritty of electrical and overhead costs, each halving creates a dilemma for Bitcoin miners: Either their costs go down or the price of Bitcoin goes up. If not, the miners cannot profitably produce Bitcoin and will go out of business. The original thought for Bitcoin was that the transaction fees users pay to send Bitcoin will eventually overtake the subsidy and create a sustainable revenue stream for miners. Today, that isn’t the case with transaction fees making up around 2% of miner revenue (meaning the subsidy is 98% of their income).

In order to boost transaction fees, an improvement to the Bitcoin protocol was proposed to create what are called “drivechains.” Drivechains would add “layers” to Bitcoin, where developers and companies can create their own economies using Bitcoin, but still take advantage of Bitcoin’s incredible security and infrastructure. These drivechains would need to submit transactions to Bitcoin in order to continue operating, thus creating a floor for transaction fees.

The thought is that Bitcoin is limited in how wide it can scale since it doesn’t have smart contracts and can’t process transactions very quickly. To compensate, drivechains would be able to piggyback off of Bitcoin’s security and brand name, but can provide those added features on a different layer. Over time, and with enough active drivechains, the transaction fees paid by those drivechains (as well as users moving in and out of them) would drive up miner revenues enough to compensate for the continuously halving subsidy.

No Way to Tell

There are strong arguments both for and against drivechains. Proponents argue that it will save Bitcoin from abandonment once the miner subsidies end (which is expected to be in 2140 - and, no, that’s not a typo, it’s in over 100 years). If the subsidies still make up the vast majority of miner revenue in 50 years, then that’s a fair argument. Nobody would want to become a Bitcoin miner if they knew they’d be out of business in the foreseeable future.

On the other side of the argument are those who suggest that the upgrade would draw attention away from Bitcoin and catalyze the proliferation of scams via sidechains. Most tokens on Ethereum are scams or completely useless, so opponents want to resist the same fate for Bitcoin. Further, users might be more drawn to drivechains than Bitcoin, so network activity might actually fall and lead to a decrease in transaction fees.

There are cogent arguments on both sides of the drivechain debate, but the discord among community members makes it appear as though Bitcoin will never improve. Ethereum seems like a well-oiled machine by comparison - largely thanks to its foundation that guides upgrades and acts as an organizing body for the community. This isn’t to say that Bitcoin development is a lost cause, but changes to the protocol are far more contentious, suffer more scrutiny, and have longer review periods.

Are drivechains the right choice for Bitcoin? There’s no obvious answer. A change like this affects a $500 billion network, so it’s good that there are a lot of conversations about it. On the other hand, decentralized development allows for people to experiment rather than ask for permission. If drivechains make sense, nobody needs permission to launch them. In other words, there should be less debate and more action: If you build it, they will come.