Crypto Cream: How Timeframe and Thesis Determine A Token's Success

Pongo Points:

• Crypto is a fast-paced industry. Markets trade 24/7, automated bots can conduct arbitrage trades in a matter of milliseconds, and there's seemingly a new, game-changing token released every month. Yet why is it that the same 3-4 cryptocurrencies remain at the top after so many years?

• Cream rises to the top and the same happens in crypto - only over a longer time period. Bitcoin has remained the top cryptocurrency by market capitalization since inception. Ethereum has (mostly) remained in the second spot since launch. What causes the vast number of other "major cap" cryptocurrencies to fall into obscurity?

• A token's brand ossifies over time, with first-movers typically maintaining dominance despite the constant influx of newer and more advanced protocols. However, during most cycles, even the most hyped projects with seemingly incredible prospects lose value harder and faster. What keeps a protocol alive after its "best buy" date?Cream of the Crop

Blockchain has the potential to create a more efficient infrastructure system for finance, AI, and the internet. Everything from settlement and transaction costs to notarization can be streamlined, yet many of the projects today seem far off from realizing those improvements. There’s more interest and development focused around NFTs, gambling, and speculation than meaningful solutions to modern friction points.

Part of this is due to social and regulatory roadblocks, but a major component is due to the fact that blockchains, smart contracts, and the like are still new and largely untested. It’s not totally clear how they are best implemented into existing workflows, or if they are fit to replace any of our current infrastructure. The bet the crypto industry is taking is one of blockchain proving to be a better data management and transfer system.

Just like the early internet and email eras, the crypto industry suffers from a number of scams and pointless creations. Of course, not everything falls into those categories, but around 98% of all tokens do. It’s the reason why Bitcoin, Ethereum, and Ripple have remained among the top three cryptocurrencies by market capitalization for nearly a decade. But it’s not the only reason.

When coins start to advertise “faster transaction speeds” or “fairer token economics,” it’s a sign that innovation has gone stale. Are faster transaction speeds a good thing? Sure, but faster transactions speeds for what exactly? Trading useless tokens for other useless tokens? Even after 14 years, crypto is rife with scams, but, like cream, the quality projects rise to the top over time. Let’s churn out some reasons why.

Cream Among Memes

Rather than pointing to the reasons why projects like Bitcoin and Ethereum are successful, it’s easier to identify why other projects fall into obscurity. A key factor in spotting a potential loser is that it lacks genuine novelty. This might seem obvious on the surface, but, when one truly digs into crypto research, nuance can blind better judgment. As touched on above, faster transaction speeds are obviously “good,” but what if speed isn’t a roadblock to adoption at this point? Is it still better?

Bitcoin was a novelty in itself. A new monetary system that is cryptographically secured using game theory and energy. Ethereum was a novelty by introducing the concept of smart contracts, which are computer-based contracts that don’t require an intermediary to settle. Even though Ethereum iterated on Bitcoin’s blockchain concept, it presented a fresh application for it (instead of just money, like Bitcoin’s initial concept).

Coins like Peercoin and Neo were immensely popular in the 2014 and 2018 bull runs, because they were “novel” adaptations of existing coins. Those who missed Bitcoin or Ethereum could invest in those coins, hoping that they would get a larger return on investment. Peercoin’s “innovation” was proof-of-stake, which hasn’t proven to offer more value to Bitcoin’s core thesis of peer-to-peer currency. Neo’s innovation was faster transaction speeds, but with no reason to want to exploit them. Improvements? Sure, but you don’t buy a Ferrari to get to work if your only motivation is transportation.

Bitcoin and Ethereum remain largely unmatched at the top of the charts for cryptocurrencies, not because they’re the pinnacle of blockchain, but because they introduced genuinely exceptional innovations. For a token to survive the steep drops that are commonplace in crypto, they must offer something more than “premium” Bitcoin or Ethereum at this point. However, that alone isn’t enough to protect them from failure - they must be used too.

Sell-Buy Date

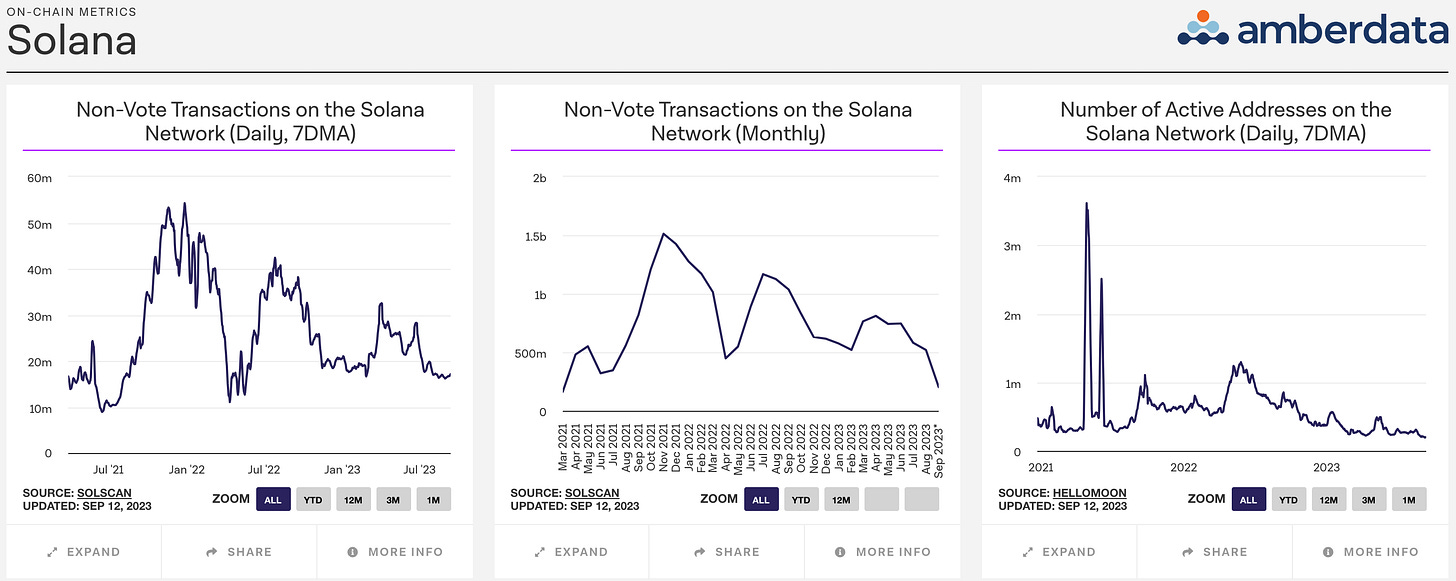

In addition to have a useful purpose, a token must also serve its purpose. In simple terms, Bitcoin and Ethereum tokens are used because users want to transact on those networks. Solana did well during the NFT and DeFi gold rushes when Ethereum’s blockchain was crowded, slow, and expensive to use, but it has suffered a far steeper decline from it’s all time high (down over 92%) than Bitcoin (-62%) or Ethereum (-67%). Why? Because Solana is struggling to maintain as robust a user base as transaction speeds and cost are less of an issue on Ethereum.

This isn’t to say that Solana is a pointless “upgrade” to Ethereum: It can certainly have specific applications in different fields, but, compared to the Ethereum NFT and DeFi markets, it simply can’t compete. It’s the reason why multiple NFT and DeFi projects that originally launched on Solana have since migrated to Ethereum. Fewer users means less demand for the token, thus the steeper drop in price and a harder road to recovery.

Just like determining if a protocol is offering something genuinely novel or not, it’s better to determine how a token is used than why it is used. The distinction in those two words is subtle yet impactful: Why do I have a credit card? For a convenient way to spend my money. How do I use my credit card? To pay for groceries, luxuries, and more. In crypto, there’s a tendency to focus on why a token will be used: To pay for transactions on the network, of course! But how a token is used, such as to pay for goods, settle smart contracts, or transfer data, is a good indicator of it’s longevity.

Of course, there are always tokens like Dogecoin and Litecoin that confound this idea. They both admit to being a near-replicas of Bitcoin (in concept), but have somehow remained among the top cryptocurrencies for nearly 10 years (despite falling 92% and 85% from their highs, respectively). Perhaps it’s more a testament to how new crypto and blockchain really are, since we’re all still figuring out if any of this technology has any value. But this ape thinks that the cream of crypto will rise to the top.