Aligning Incentives: Why DeFi Won't Work

Pongo Points:

• DeFi aims to become a more democratic and fair reinvention of the global financial system. On the surface, developer ambitions appear righteous and well-intentioned, but, in practice, the notion of decentralized governance doesn't necessarily enable the type of "fairness" that developers seek to create. Why won't this popular use case for blockchains work in the future?

• Many DeFi protocols struggle with aligning incentives for developers and users over the long term. Decentralized organizations pride themselves on novelty and adaptability for the digital age, but have not proven to be effective replacements for traditional company structures. In order to do so, they must have clear paths to delineate decentralization from discoordination.

• Initially, a DeFi protocol's team might reserve a large portion of the tokens for themselves in order to fund expansion and development. A decentralized entity cannot pay bills without income, but if it's governed by a decentralized autonomous organization (a "DAO"), then there's no way to force token holders to earmark funds to pay those bills. Worse yet, there may be no way to compel action legally either.Artificial Inception

Those of you in the Pongo Pod are familiar with this ape’s distrust for decentralized finance (or “DeFi”). While so many blockchain evangelists praise this crypto subsect as a more equitable approach to global finance, it’s not much more than a casino in its current state. The vision for DeFi is to democratize access to wealth building tools, like capital markets and leverage. Unfortunately, those building and funding many DeFi protocols are blind to the actual needs of society.

Someone living in poverty doesn’t need to leverage their assets (if they have any), so liquid staking derivatives, collateralized debt positions, and automated market makers are likely not going to appeal to them. If 37% of the population in one of the wealthiest countries in the world struggles to manage a $400 expense, then they likely need a way to save their income that doesn’t require minimum balances or charges overdraft fees.

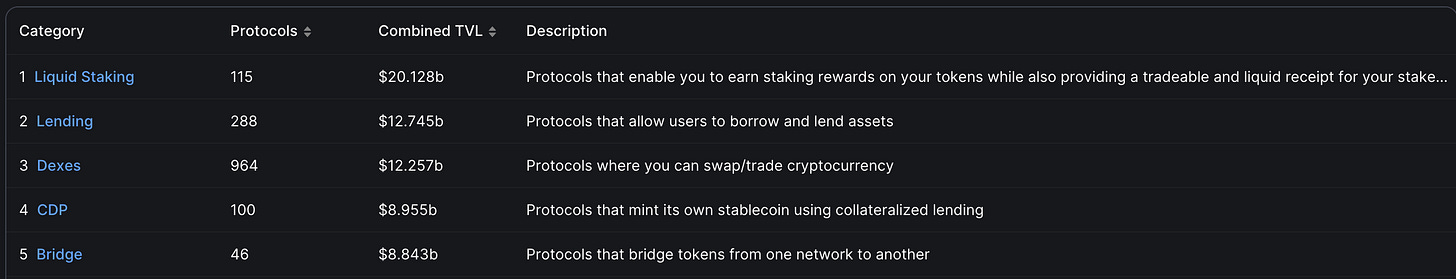

Why is it, then, that DeFi attracts so much money? Across a number of blockchains, there’s nearly $50 billion in value locked into DeFi protocols (as of this posting). Venture capital firms have raised hundreds of millions, if not billions, to support the development and growth of DeFi protocols. In return for their investment, these venture firms are awarded governance tokens in these protocols, which are effectively shares in the protocol (if not actual shares of the company developing the protocol - sometimes even both).

The results of these investments create a similar dynamic to existing financial frameworks: That of the “owner” (or shareholders) and the “users” (or customers). The users who struggle today do not enjoy any marked improvement to their financial tools, but technologists become the new gatekeepers for the economy rather than the banks. In other words, the masters are different but the game is the same. Why are DeFi protocols attracting so much attention? Let’s cut through the monkey business.

Anarchic Inspirations

In a traditional structure, companies and shareholders are aligned in that they work to generate more revenue than expenses. This enables the company to pay its employees and grow, while the shareholders capture value in excess of the company’s liabilities. If the shareholders act greedily, extracting more value than the company can generate, then the company will eventually fail. Conversely, if the company or its agents act maliciously, then the shareholders will not invest in the company, leading to the close of the business. At a basic (and theoretical) level, incentives are aligned.

In a DAO structure, the “owners” of the protocol are the DAO-token holders and the developers are the agents for protocol. The thought is that DAO-token holders will act in the same way that shareholders of traditional companies would, and that developers would act as employees. However, the breakdown in similarity is due to poor coordination. DAO-token holders are motivated to see the protocol grow, as their tokens would either accrue value or pay dividends, but developers are not beholden to the protocol as they would be to a company.

DAOs typically offer grants to developers that add value to a protocol. Some might even offer long-term contracts to dedicated developers, but there’s no way to truly “hire” someone as a traditional company might. As a result, the protocol is maintained by groups of mercenaries rather than a coordinated central entity. Unfortunately, this leads to a lack of accountability, unpredictable growth, and questionable legal protections for investors and users - none of which are hallmarks of an enduring business model.

In order for DeFi protocols to survive, they must prove that decentralization doesn’t cause disorganization. Perhaps this ape lacks creativity, but that would require some form of centralized decision making and accountability. At that point, what’s the difference between a DAO and a company? The current workaround is to have foundations guide development, but that ultimately leads to the Foundation Problem. Said differently: Financial tools require some central coordination in order to function efficiently, so DeFi is handicapped by the very nature of its decentralized structure.

Applied Investment

Assuming a DeFi protocol finds an efficient workaround to the coordination problem, how does it expand? In traditional markets, investors seek companies that have clear paths for growth, with the expectation that the added value will accrue to them via dividends or share price appreciation. This attracts more investors to the company, and these new investors/funds will create a positive flywheel for the company to continue expanding. This clearly doesn’t apply to all stocks (e.g. meme stocks), but that’s the foundation for value investing.

Most DeFi founding teams reserve a large portion of initial tokens for themselves, which are typically used to fund continued development. Over time, the founders sell tokens to pay grants and expand teams, but, of course, these funds are limited and will eventually run out. A traditional company can hold some revenues to fund growth, but a DeFi protocol doesn’t always have revenues that it can retain. Many DeFi protocols pay users to participate or provide liquidity, without much (or any) value accruing to the DAO token holders or the protocol itself.

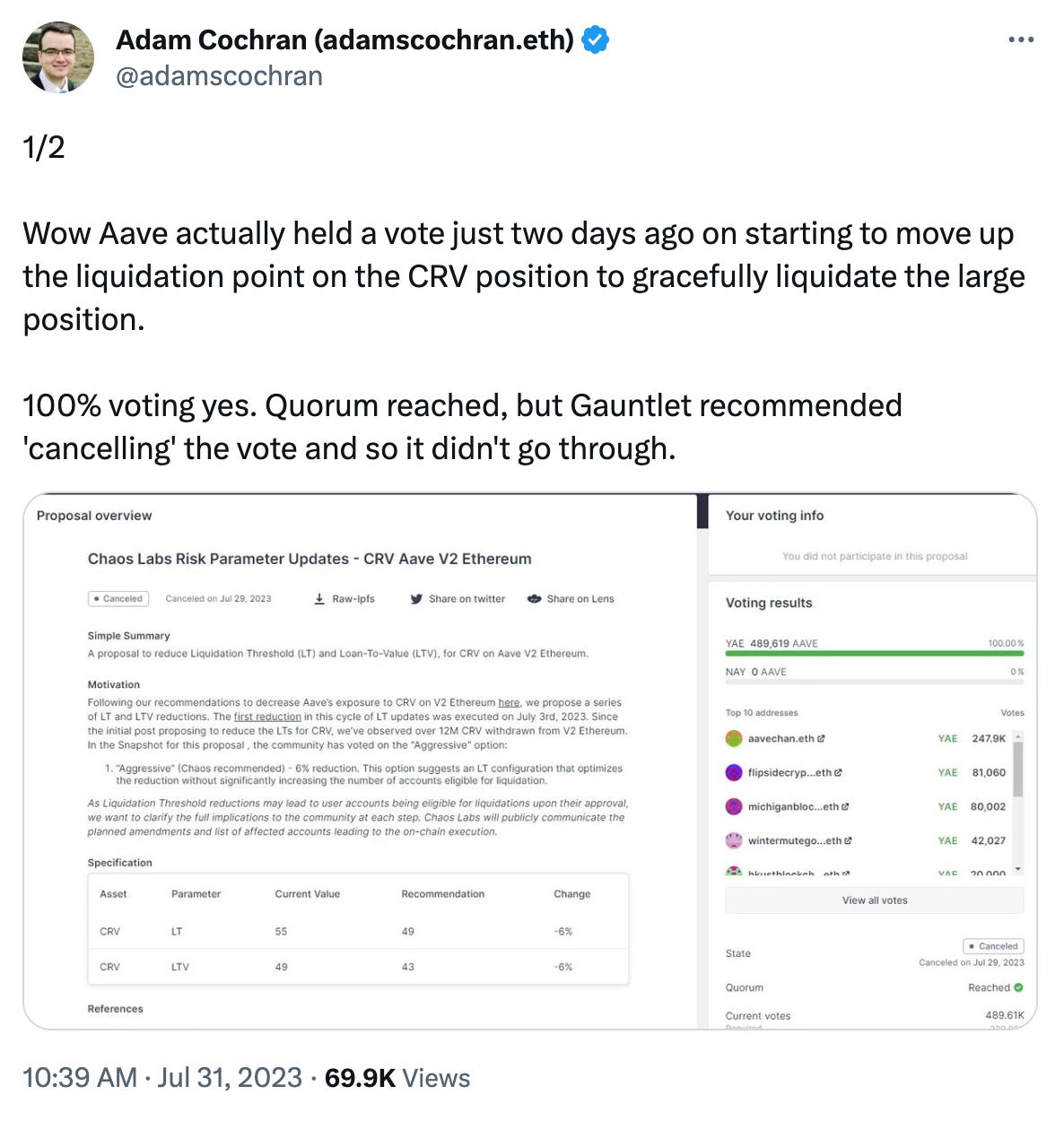

Worse yet, the DeFi protocol might not have the ability to make changes to its revenue model to enable expansion. DAO governance is slow and extremely fragmented; votes on changes can take weeks and quorum might not be met. Further, how does a DAO compel developers to enact changes? Remember, most DeFi protocol developers are mercenaries, so, if they disagree with a particular modification or upgrade, there’s no way to force them to comply. Historically, most DeFi teams typically do what they want anyways, regardless of DAO votes.

Because “decentralized” autonomous organizations are not typically incorporated in any jurisdiction, this leaves token holders without legal remedy for a developer’s breach of fiduciary obligation. A company’s shareholders enjoy many rights in most countries, but DAO token holders can only look to the blockchain. Sure, token holders can elect to fork the code and create a new DeFi protocol, but then who maintains it? Social consensus is a powerful tool, but coordinated effort is required to enact it.